Driving Financial Evolution with Advanced Technology

Transforming fintech by moving from conventional methods to digital solutions, unlocking the full potential of technological automation for greater efficiency and profitability.

Shaping the Future of FinTech with PGC Digital

At PGC Digital, we help fintech firms stay ahead by leveraging cutting-edge technology to navigate financial markets, optimize portfolios, and drive smarter decisions. Our all-encompassing solutions foster an efficient and adaptable ecosystem, positioning clients for future success. By combining data science, engineering, and visualization, we empower businesses to scale, minimize risks, and enhance customer loyalty.

Overcoming FinTech Challenges with PGC Digital

At PGC Digital, we understand that with the rapid pace of technological adoption and the rise of new competitors, FinTech companies face pressing challenges in the financial services sector. These include improving outreach, delivering exceptional customer experiences, reducing operational inefficiencies, and driving the widespread adoption of digital solutions. By leveraging our expertise, we help FinTechs overcome these hurdles and position them for success in an increasingly competitive and digital-first market

Key Features and Benefits

SAP S/4HANA Finance (formerly SAP Simple Finance)

This module streamlines financial accounting, controlling, and financial operations. It integrates financial processes across different departments and helps businesses to comply with financial regulations, improve reporting, and enhance financial decision-making.

SAP Treasury and Risk Management (TRM)

SAP TRM helps manage financial risks, including liquidity, cash management, and investments. It provides tools to handle market risks like currency and interest rate fluctuations, enabling FinTechs to manage financial instruments and transactions efficiently.

SAP Customer Relationship Management (CRM)

This module focuses on managing customer relationships by providing a 360-degree view of the customer. For FinTech companies, CRM helps to track customer interactions, enhance personalization, and improve client servicing and retention strategies.

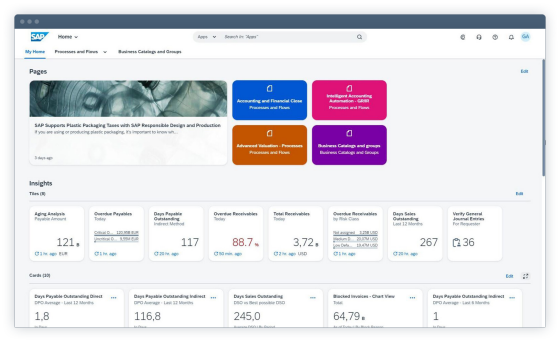

SAP Business Technology Platform (BTP)

SAP BTP enables FinTechs to integrate, innovate, and scale with an open, flexible platform. It offers capabilities in data management, advanced analytics, and AI, allowing financial institutions to leverage data for better insights, personalized services, and faster innovation.

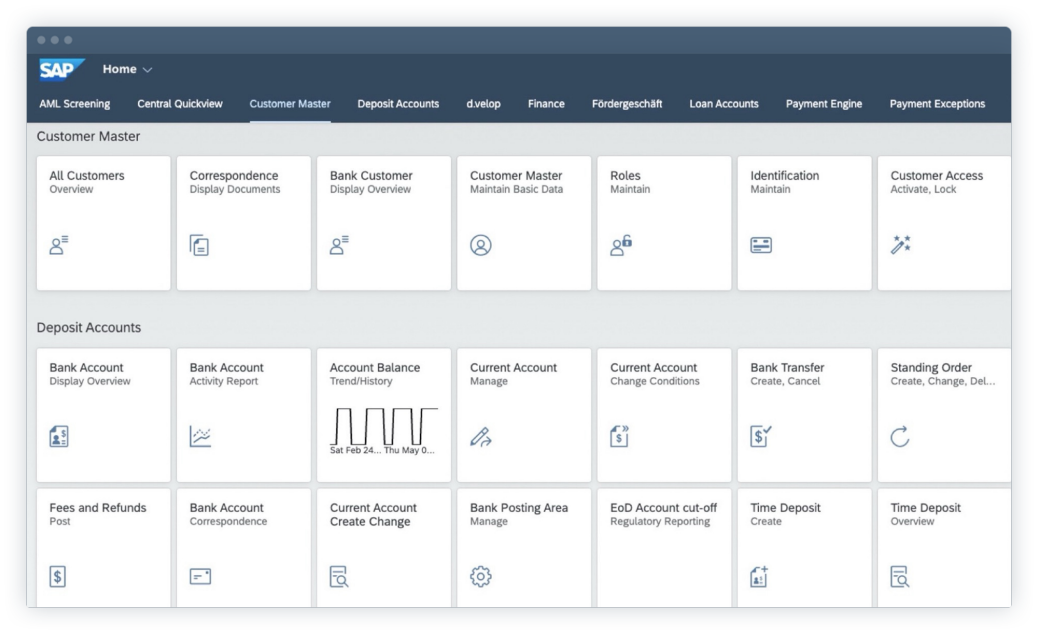

SAP Banking Services

This module is specifically designed for the banking and financial services industry. It covers core banking processes such as transaction management, account management, loan processing, and payment processing, ensuring seamless and secure financial services.

SAP Data Intelligence

SAP Data Intelligence helps FinTechs to manage large volumes of structured and unstructured data. It integrates and processes data from various sources, enabling advanced analytics, machine learning, and AI to support decision-making, fraud detection, and risk management.

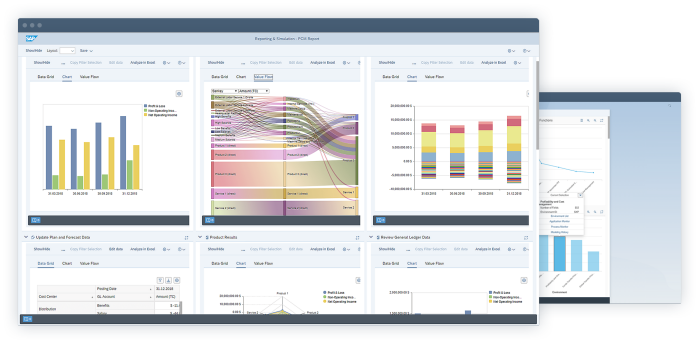

Image Source: SAP.com

Migration to cloud banking ERP

Explore the advantages of cloud ERP by maintaining your unique configurations and meeting both business needs and compliance standards efficiently.

Image Source: SAP.com

Ready-to-run cloud banking ERP

Enhance efficiency, boost flexibility, and elevate product and service quality with our smart, cloud-driven ERP solution.

Image Source: SAP.com

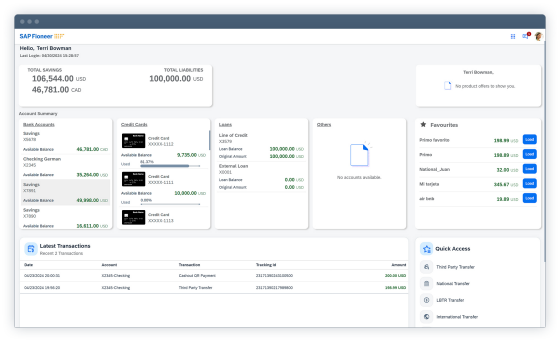

Cloud banking

Develop, expand, and refine new products with adaptable cloud-based banking processes tailored to seize market opportunities and enhance customer satisfaction.

Image Source: SAP.com

Omnichannel banking

Connect with banking customers through various channels and leverage advanced technologies to streamline processes and boost operational efficiency.

Image Source: SAP.com

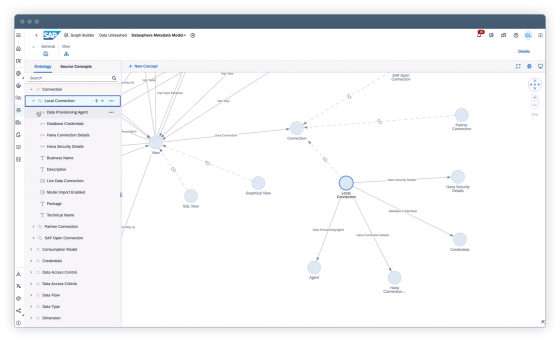

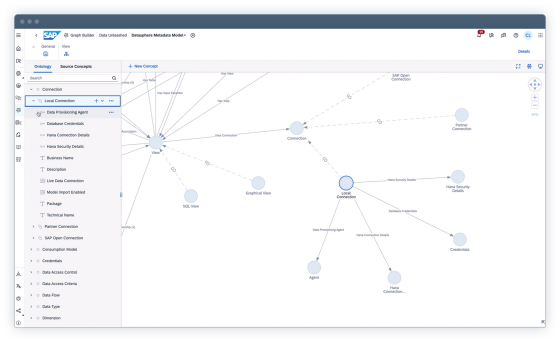

Data landscape management

Provide seamless access to essential business data across hybrid and cloud banking environments, ensuring availability and simplicity for users.

Image Source: SAP.com

Financial management

Manage financial data efficiently, mitigate risks, and control expenses with our cloud-based banking ERP solution, delivering real-time insights and enhanced accuracy.

Image Source: SAP.com

Financial modelling

Empower your team with user-friendly cloud banking tools to design, implement, and manage flexible business models seamlessly, without relying on IT support.

Image Source: SAP.com

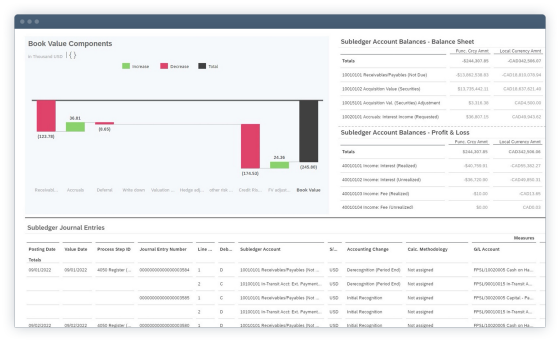

Accounting for financial products

Streamline your operational and financial processes with a unified system, ensuring transparency, compliance, and audit integrity while supporting long-term sustainability in a dynamic regulatory landscape.

Image Source: SAP.com

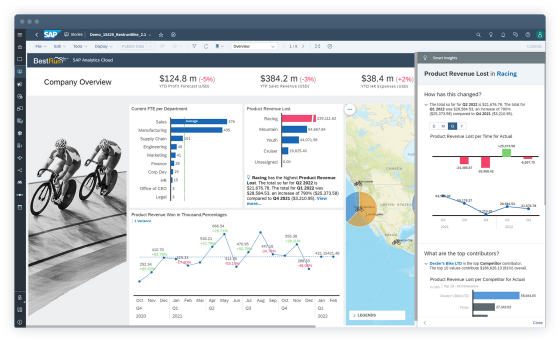

Cloud analytics

Leverage ready-to-use business insights to provide finance-specific analytics and empower informed decision-making through real-time data analysis.

Image Source: SAP.com

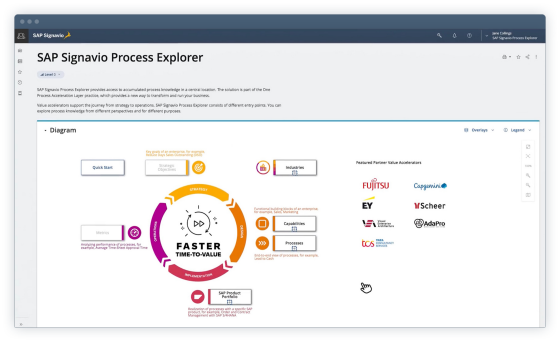

Process transformation

Enhance, optimize, and revolutionize your banking operations, driving rapid and scalable transformation across business processes.

Image Source: SAP.com

Data landscape management

Ensure seamless access to essential business data across both hybrid and cloud banking environments, streamlining data delivery wherever it’s required.

Image Source: SAP.com

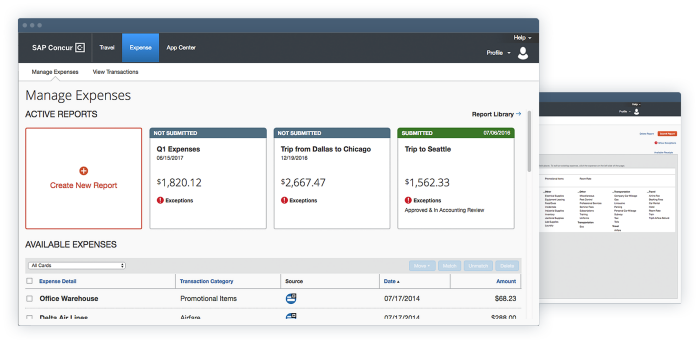

Travel management

Gain a unified perspective on travel bookings, ensuring travelers adhere to policies, safeguarding duty of care, and minimizing financial risks.

Image Source: SAP.com

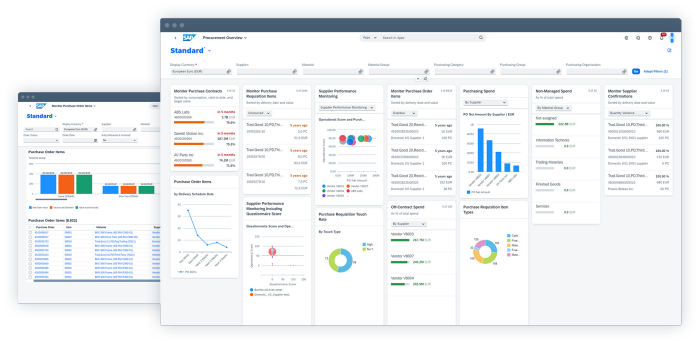

Procurement management

Simplify the procure-to-pay workflow, helping employees make optimal purchasing choices while fostering strong supplier collaboration.

Image Source: SAP.com

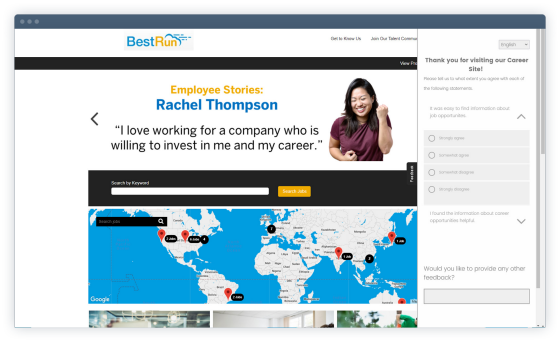

HR management

Integrate core HR functions, payroll, talent management, sales performance, workforce analytics, and strategic planning for seamless operations.

Image Source: SAP.com

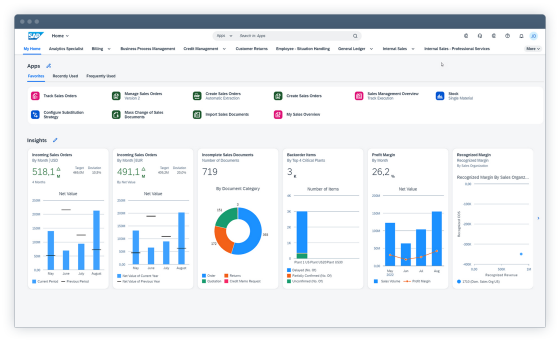

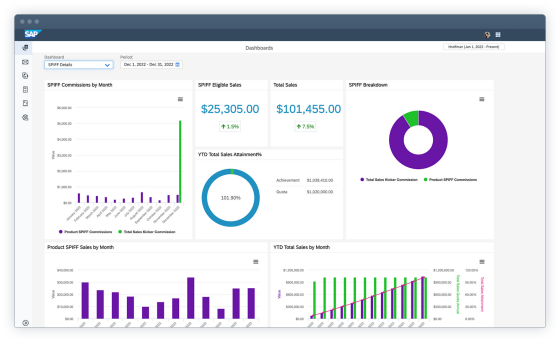

Sales performance management

Simplify sales planning, drive motivation, influence behavior, and boost revenue through effective incentive compensation management.

Image Source: SAP.com

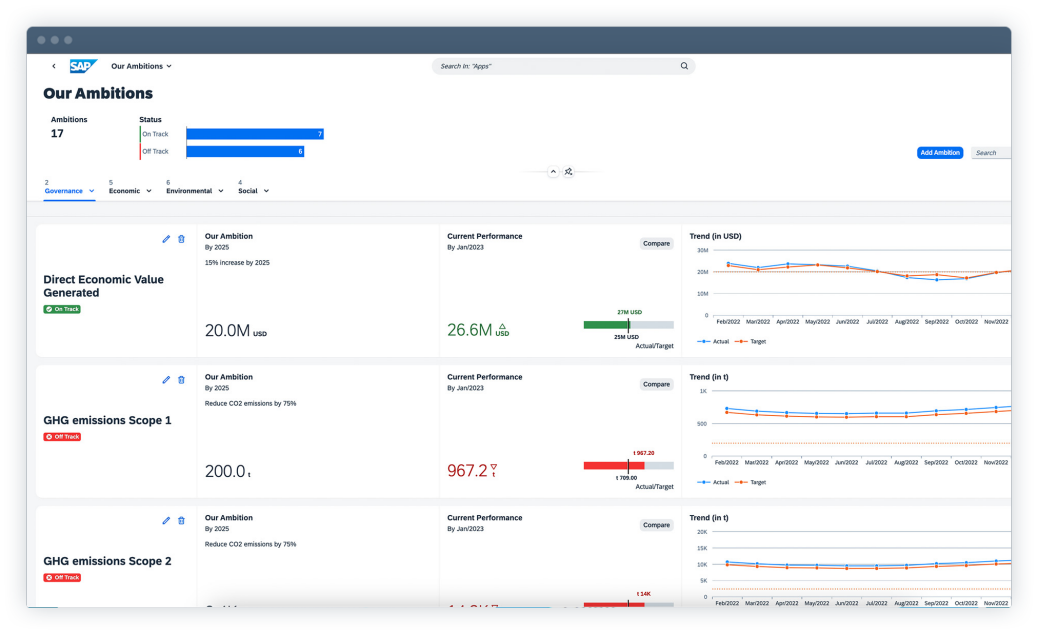

Sustainability goal tracking

Enhance visibility into environmental, social, and governance data, and track, report, and take action on your sustainability goals.

Image Source: SAP.com

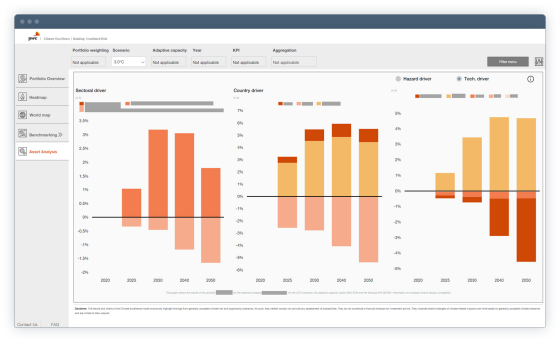

Scenario analysis for your investment portfolio

Evaluate the financial impact of various climate scenarios on your investment portfolio and assess the robustness of your business model.

Image Source: SAP.com

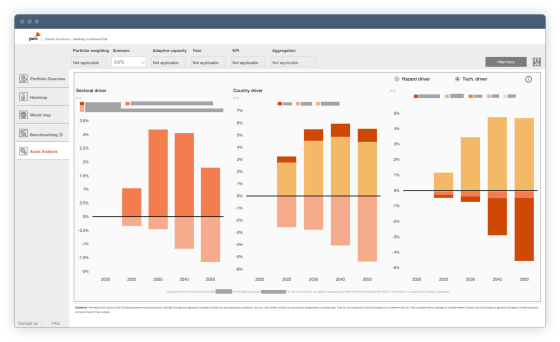

Scenario analysis for your credit and finance portfolio

Incorporate climate stress testing into your current processes to identify the critical risk and opportunity factors impacting your credit and financial portfolio.

Strategic Partnerships That Move Your Business Forward

With established collaborations across top-tier enterprise IT platforms, we offer tailored digital transformation services. Our broad ecosystem of technology specialists and consultants ensures innovative, business-specific solutions for long-term success.